1884 – Data Analytics and the Art of Infographics: Hail Tables

Agriculture has always been exposed to natural disasters, capable of ruining a year’s harvest and sometimes even those of subsequent years. And hail was the most feared of all, given its unpredictability. The fact that in 1834 the French Academy launched a competition to find the scientific basis for its formation gives an idea of the extent of the problem.

As hail is a very complex phenomenon, unsupported by scientific explanations that could in some way reduce its effects, those working in the sector were left at the mercy of events and more or less ingenious solutions, like the use of hail cannons.

The means of defence against the adversities of hail most widely used by farmers is without doubt insurance.

The first hail insurance company was created in 1791 in Germany, followed by one in France in 1799, while in Italy, Angelo Patracchi established the Società dei compensi vicendevoli pei danni della grandine in Milan in 1827.

The undertaking, though commendable, appeared somewhat late in the day. Companies had in fact hesitated to operate in this sector due to the difficulty of setting premiums, given the unpredictability of this atmospheric phenomenon. But, in 1836, thanks to Generali, the first Italian insurance policy against calamitous hail damage was issued.

During that year, Generali had absorbed Angelo Petracchi’s company, and therefore had a clear view of the situation. The aim was to provide people-friendly insurance cover. However, this was a challenging enterprise: the Italian economy was predominantly based on agriculture but production was barely enough to support families. Generali understood the need to invest in agricultural insurance. This decision was not only indicative of a technical choice but also of an innovative marketing policy based on technological progress and the specific desire to promote the concept of private insurance among the population.

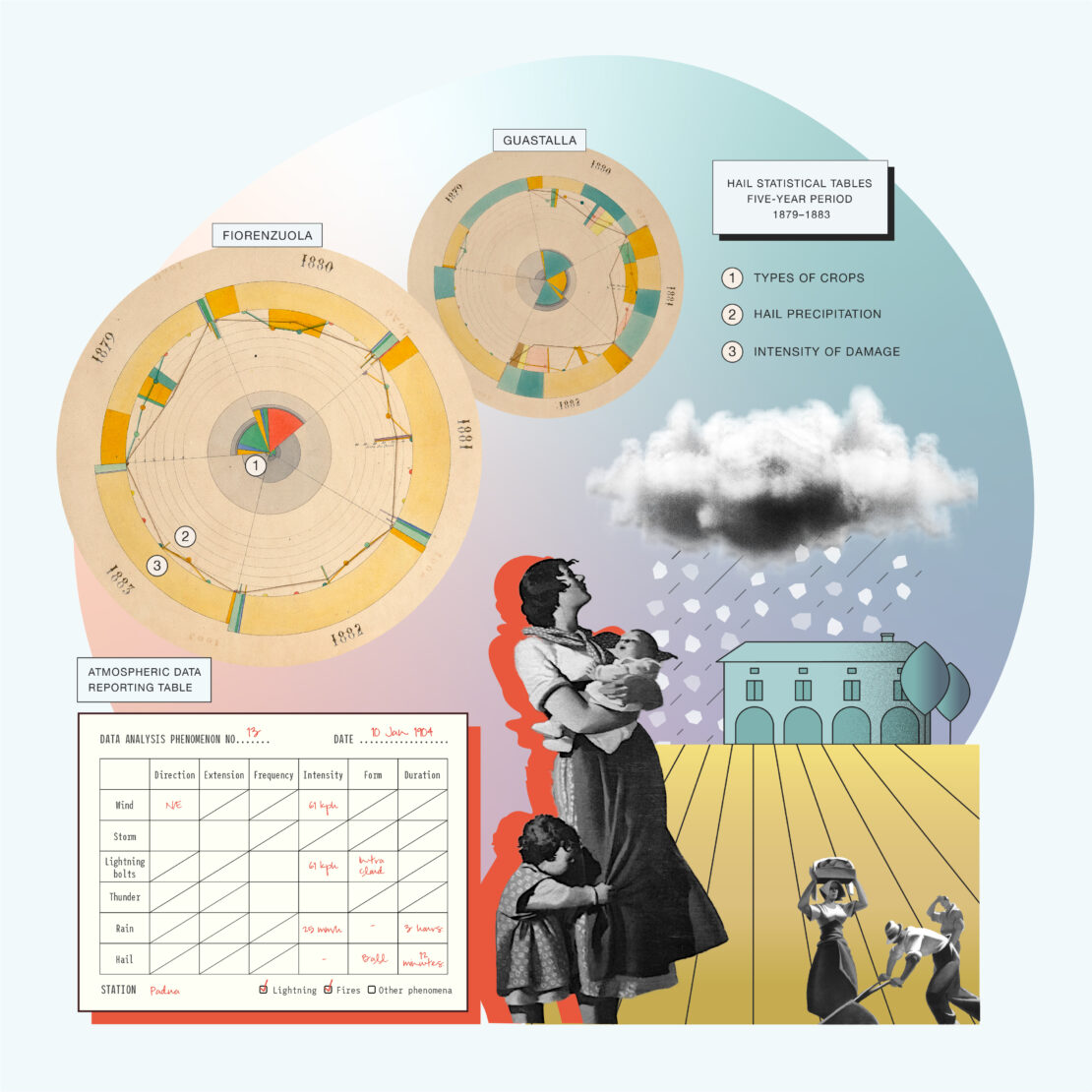

When choosing an approach, Generali realised that hail insurance was a neglected sector lacking reliable data. With extraordinary acumen and application, the company set about compensating for the statistic deficit. An extensive network of agents spread across the region, pre-compiled cards in hand, endeavoured to record the effects of every single storm: frequency, intensity, type of lightning, thunder and hail, as well as wind direction, and the most affected and damaged crops. The data was collected by geographical area, processed and sent to the Central Meteorological Office in Rome, with which the company worked from 1881, and shared with the insurance institutions with which Generali was syndicated, in order to obtain uniformity of criteria in damage assessments.

In addition, Secretary General Masino Levi devised an innovative formula that provided for full damage compensation after the expert report, pricing of premiums according to the quality and location of the product and, above all, policyholder participation in profits. The agents were very thorough. At the beginning of the season, the product was insured for the production value estimated as possible on the plots and, in the event of a hailstorm, experts of proven “reputation and honesty” were sent to assess the damage suffered by the policyholder. To encourage the signing of a policy, Generali took part in the experimental campaign for hail cannon use by contributing to the expenses incurred by policyholders for the equipment, as well as offering a discount on the premiums of the policies underwritten.

Another innovation introduced by Generali in 1867 was the multi-year contract. The other companies offered annual coverage subject to variations, limitations or suspension of operations. Generali, on the other hand, wanted to respect the idea of insurance continuity, and give guarantees over time. In this way, this sector became increasingly well-established.

By the early 1880s, Generali had become so widespread geographically that a new organisational strategy was required: it was decided that affiliated companies would be set up, sometimes specialising in certain branches of activity, including hail. The Secretary General at the time, Marco Besso, decided to dispose of the dedicated hail branch and instead created ad hoc companies in the regions where demand was highest. Thus, the Società di assicurazione contro la grandine e di riassicurazione was established in Budapest in 1889 for Austria-Hungary, and the Società anonima di assicurazioni a premio fisso contro la grandine – re-named Anonima Grandine from 1931 – was set up in 1890 in Milan for the Kingdom of Italy. This change of course was indicative not only of a technical choice, but also of an innovative marketing policy. The transformation was also expressed through a more appealing mass communication strategy: an Anonima Grandine poster from the period depicts a farming family under an umbrella, demonstrating that the company aimed to approach the community with passion, humanity, and empathy.

The data gathered by the agents was also used to create diagrams and cartograms to accompany the records, prestigious publications intended for national and international exhibitions, presented in 1881 at the Industrial Exhibition in Milan and in 1884 at the Turin Exhibition, where Generali won the gold medal for its work in the sector. The first page of the album exhibited on this occasion depicts a circle divided into segments, symbolising agricultural products, the damage caused by hail, and their distribution over the years. It is almost like looking at a diorama, in which the fury of the hailstones is curbed by human perspicacity and the developments in insurance, surrendering to colours: ashen mulberry leaves, orange wheat, turquoise flax, grass green oats, red corn, emerald green rice, yellow hemp, purple grapes – all the colours of agriculture.